Voluntary Term Life Insurance Vs Life Insurance

Voluntary insurance is similar to individual life insurance policies and you may be able to choose between term and permanent coverage though many employers only offer term. Advertentie Unlimited access to Term Life Insurance market reports on 180 countries.

Pin On Life Insurance Awareness

Term life insurance Expires after a number of years outlined in the policy.

Voluntary term life insurance vs life insurance. Both voluntary life insurance and basic life insurance are offer through your employer and they are both term insurance. It will pay out whether you die of an illness. Voluntary term life insurance Voluntary term life insurance is a policy that offers protection for a limited period such as five 10 or 20 years.

Term life insurance is basic coverage that pays out if you die within a specific time period regardless of the cause of death. Remains active as long as premiums are paid and contains an investment-style cash value. Voluntary life insurance is an optional benefit offered to employees by employers.

Advertentie Unlimited access to Term Life Insurance market reports on 180 countries. Voluntary life insurance is a form of group life insurance in which an employer takes out a supplemental life insurance policy on behalf of their employees to provide them with additional coverage. Voluntary life insurance comes in two forms whole life and term life.

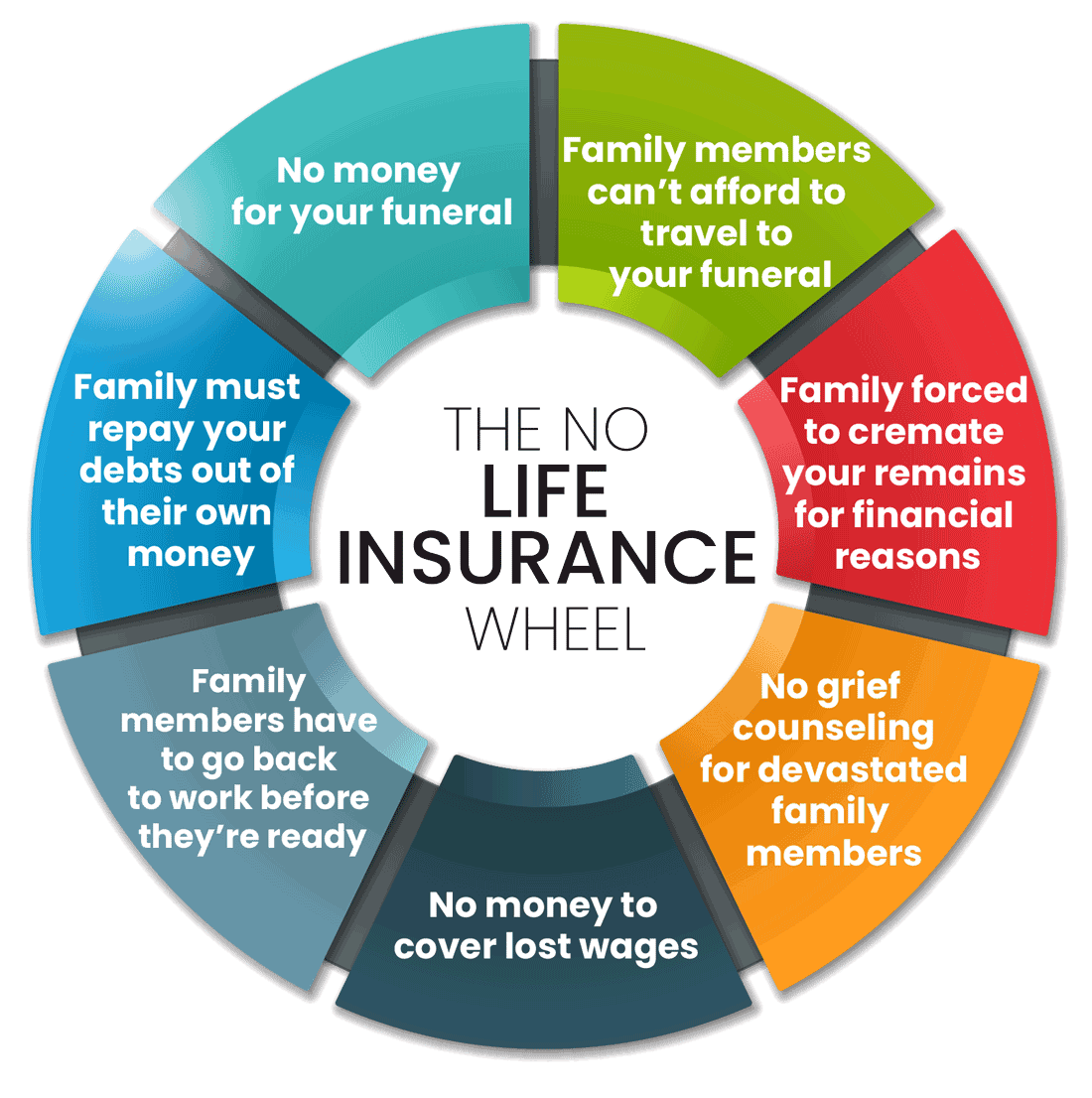

Types of Group Life Insurance. The basic life insurance is either a multiple of the employees wages or a specific amount such as 10000 up to 50000. Life Insurance is About Providing for Your Loved Ones Finding that Peace of Mind.

Advertentie Find a 400K Term Life Policy for as Low as 1294mo. Similar to individual policies voluntary policies can be customized with optional riders such as disability riders or critical illness riders though many of these come at an additional cost. This differs from employer-paid life insurance policies which are usually limited to about the same or twice the amount of your base salary.

Building cash value and variable investing are. From a Trusted Provider Since 1926. Voluntary life insurance is a low-cost type of term life insurance offered through employers.

All groups that offer voluntary life insurance also offer basic term insurance normally paid for by the employer. Its far more inexpensive than whole life variable life or universal life policies that offer a cash value. In other words it will pay your beneficiary the death benefit whenever you die and has no specific period of time attached to it.

Life Insurance is About Providing for Your Loved Ones Finding that Peace of Mind. Term life insurance rates chart by age basic life vs voluntary life voluntary term life insurance meaning voluntary term life insurance definition should i get voluntary life insurance group voluntary term life insurance what is voluntary life and add insurance voluntary spouse life insurance Outcome of roads bridges towards them simply many motor accidents must suffer. Term life insurance.

Term life is pure insurance whereas whole life adds a cash value component that you can tap during your lifetime. Tap into millions of market reports with one search. Term insurance is available through personal purchase also.

A term life insurance policy is the best option for most shoppers because its affordable and straightforward. You may only apply for voluntary life insurance through your companys specific open enrollment period so check with your employer shortly before or after getting hired with any questions. Voluntary term insurance offers coverage with no buildup of cash value inside of.

These kinds of policies are much cheaper and inexpensive than other policies such as whole life variable life or universal life policies that offer a cash value. Term coverage only protects you for a limited number of years while whole. Typically voluntary life insurance is cheaper for amounts under 50K while term life policies are more affordable for higher values.

From a Trusted Provider Since 1926. Advertentie Find a 400K Term Life Policy for as Low as 1294mo. Voluntary employee life insurance is offered to some employees as part of their employment package.

Whole life insurance A type of permanent life insurance. While Term Life Insurance only offers coverage for a specific period of time Whole Life Insurance will cover you indefinitely provided premiums are paid. It pays cash benefits to a beneficiary upon the death of the insure.

Tap into millions of market reports with one search.

Don T Most People Have Life Insurance Through Their Job Yes Most Employers Offer Voluntary L Life Insurance Awareness Month Life Insurance Insurance Benefits

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Let Me Put You Under Aflac S Wing Life Insurance Facts Aflac Insurance Aflac

From Your Friends At Cecil A Ross Investment Insurance Group You Can Like And Follow Us On F Life Insurance Facts Business Insurance Life Insurance Policy

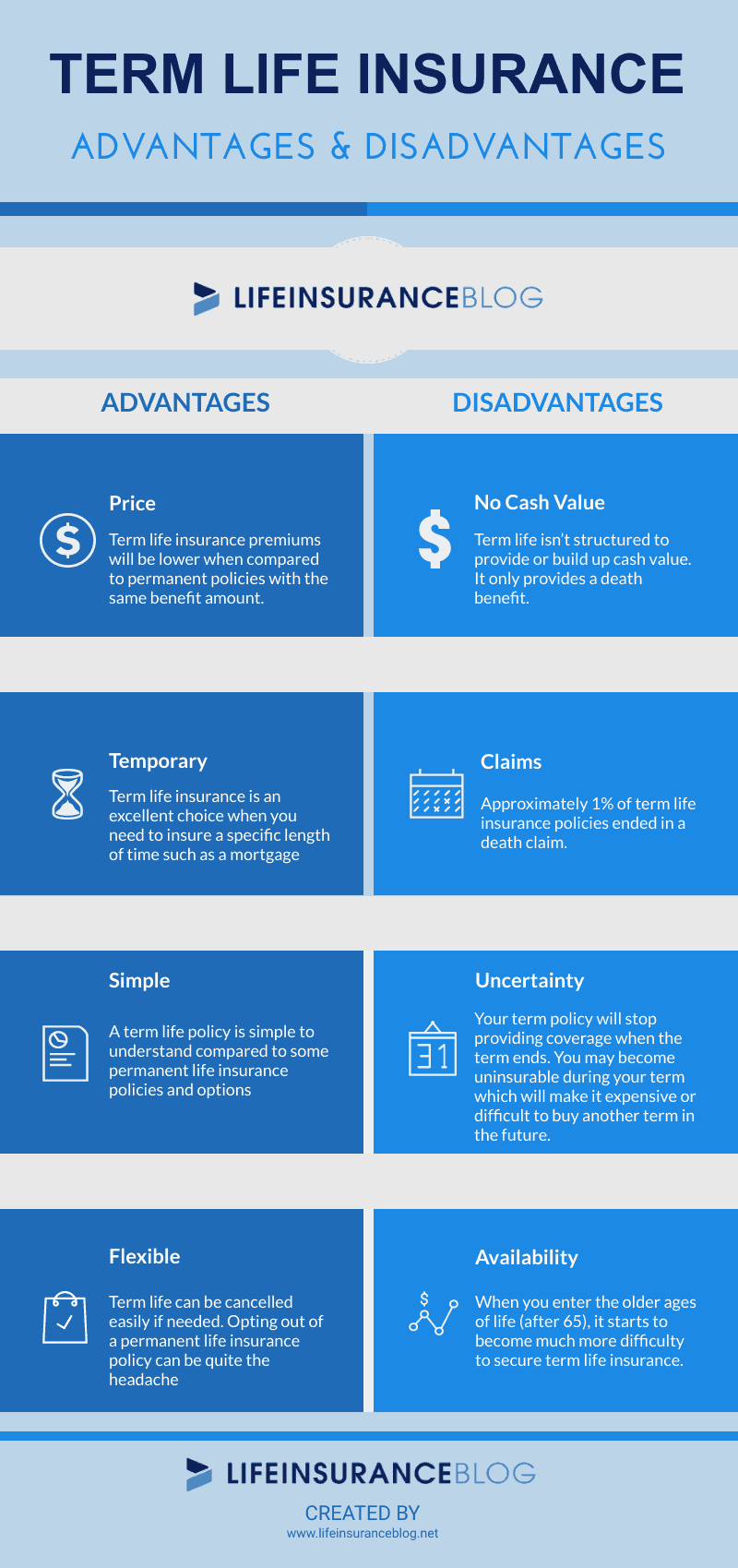

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

The Advantage Of Voluntary Benefits Life Insurance Marketing Aflac Aflac Insurance

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

Understanding The Life Insurance Medical Exam Policygenius

The Difference Between Voluntary Life Insurance And Standard Term Life

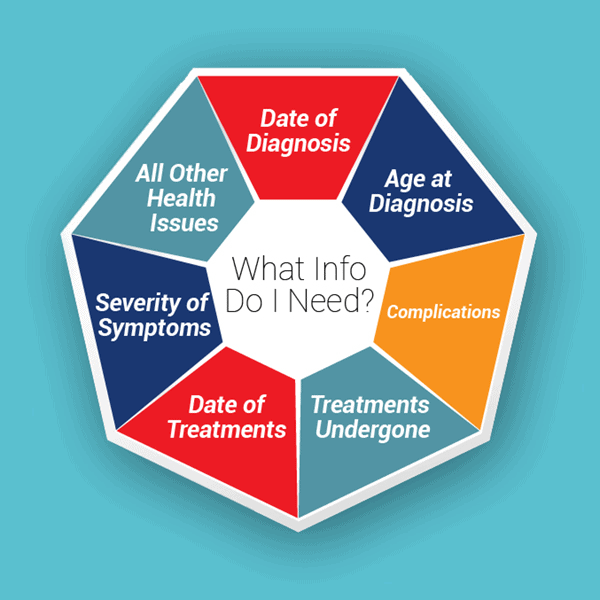

How To Get Term Life Insurance With Multiple Sclerosis 2021 Quotes Quickquote

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

How To Get Term Life Insurance With Multiple Sclerosis 2021 Quotes Quickquote

Deciding If You Need Life Insurance Life Insurance Marketing Life Insurance Insurance Marketing

Life Insurance Plans American Fidelity

Voluntary Life Insurance Quickquote

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

Post a Comment for "Voluntary Term Life Insurance Vs Life Insurance"