Do I Need Workers Compensation Insurance If I Am Self Employed

A health insurance policy usually excludes work-related incidents. Illinois law requires employers to provide workers compensation insurance for almost everyone who is hired injured or whose employment is localized in Illinois.

The Importance Of Workers Compensation Insurance

Workers compensation will cover the extensive costs of work-related injuries or illnesses but your health insurance wont.

Do i need workers compensation insurance if i am self employed. In California workers compensation insurance optional for most self-employed workers. Its a good idea to cover yourself because many health insurance plans will not help you out if you get hurt on the job. If you are self-employed or a sole proprietor the state does not require any company to provide you with insurance nor does it require you to get it for yourself.

They generally either 1 obtain an insurance policy 2 participate in an insurance pool or 3 maintain a separate appropriation for workers compensation. Texas is the only state where workers compensation insurance is optional for private employers with a few exceptions. Governmental agencies are required to provide workers compensation benefits to their employees but are not required to purchase insurance or receive approval as a self-insurer.

Employers conducting work in the State of Florida are required to provide workers compensation insurance for their employees. The fourth is insurance carriers in the voluntary workers compensation insurance market often do not have an incentive to write workers compensation insurance policies for household employers due to low premiums significant administrative burden and associated costs and perceived high risk of liability see Table 3. If you are a sole proprietor or partnerpartnership or are incorporated you do not need to seek benefits.

The number of employees can varysome states require employers to carry a policy if they have at least one employee while other states set the minimum at three employees. If you dont you wont be able to reap any benefits through the Ohio Bureau of Workers Compensation BWC. However a self-employed person can get workers compensation insurance but it may or may not be worth pursuing.

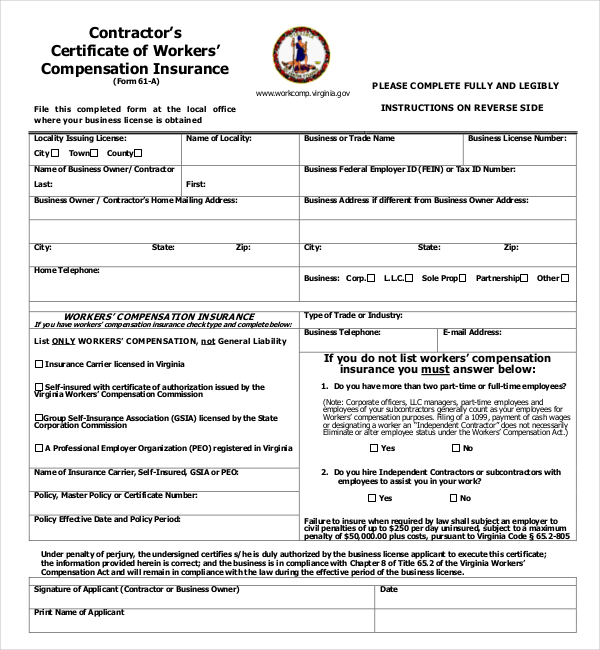

Sole proprietors business partners corporate officers and members of limited liability companies may exempt themselves. An employer may insure for workers compensation through a commercial insurer self-insurance a group self-insurance association or through a professional employer organization. Fulfill the terms of a contract.

Exempt employers that decide not to purchase workers compensation insurance or to self-insure remain exposed to civil lawsuits brought by employees who are injured during work. Therefore employers exempt from coverage remain at risk and may wish to obtain workers compensation insurance even if. If youre self-employed as a sole proprietor getting paid through a form-1099 and not a W2 you probably dont have workers compensation insurance.

Workers Comp for the Self-Employed. Commercial insurance is not available through the Commission. To cover these claims and help protect your injured workers youll need to have workers compensation insurance.

People who work for themselves and dont have employees are generally not required to purchase workers compensation insurance. Workers Comp Insurance for Self-Employed Workers If youre self-employed with no employees your business insurance requirements depend on where you live. However sole proprietors and independent contractors might purchase a policy to.

Although this is usually fine sometimes sole proprietors need workers compensation. Specific employer coverage requirements are based on the type of industry number of employees and entity organization. If youre a sole proprietor your state may not require buying workers comp insurance for self-employed businesses.

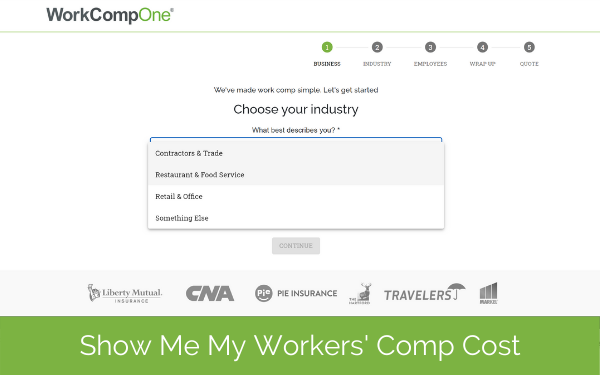

How to Get It If you work in a high-risk job such as one that requires physical labor you may want to purchase your own workers compensation insurance policy. But you will probably want to secure coverage on yourself. Whether a self-employed person needs workers compensation will depend on your local and state laws.

But even freelance writers for instance may be asked to carry workers comp insurance as a condition of the contract. If you work as a general contractor or a subcontractor you may have to buy workers comp insurance if the contract you signed requires it. State governments regulate workers comp and the rules are slightly different in each state.

Every other employer in the state of Tennessee that has five or more employees must secure workers compensation insurance coverage for their employees either by purchasing a policy from an insurance carrier or by qualifying as a self-insured employer with the Department of Commerce and Insurance. 9 The voluntary market s. Insurance Workers Compensation Insurance.

Workers Compensation Specialist Resume Samples Qwikresume

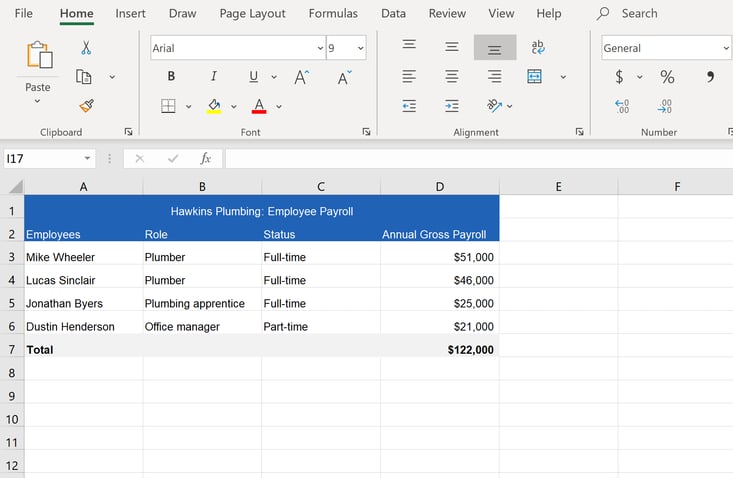

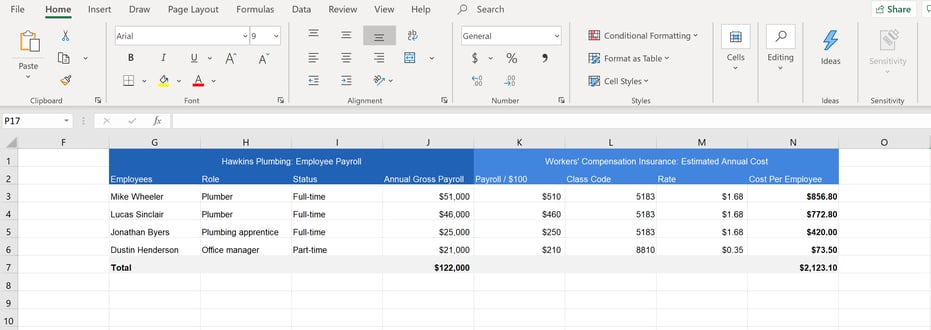

How To Calculate Workers Compensation Cost Per Employee

How To Calculate Workers Compensation Cost Per Employee

Who Qualifies For A Workers Compensation Exemption Insureon

When Do You Need To Buy Workers Compensation Insurance Insureon

Workmen Compensation Insurance Policy Labour Insurance

10 Different Small Business Insurance Policies Small Business Insurance Business Insurance Workers Compensation Insurance

The Importance Of Workers Compensation Insurance

Free 13 Sample Workers Compensation Forms In Pdf Xls Word

Do Sole Proprietors Need Workers Compensation Insurance Insureon

Your Complete Guide To Workers Compensation Martino West Workers Compensation Insurance Worker Health Insurance Benefits

Workers Compensation For Self Employed Contractors The Hartford

How To Calculate Workers Compensation Cost Per Employee

When Do I Return To Work After A Work Injury Kbg Injury Law

Workers Comp Insurance For The Self Employed Or Independent Contractors Insureon

Pin By Eric Smith On Cohealth Brokers Colorado Business Liability Insurance Workers Compensation Insurance Life Insurance Companies

Workers Compensation Department Of Human Resources

:max_bytes(150000):strip_icc()/biberk-f70909243540411181efe1bfd2c187e5.jpg)

The 7 Best Workers Compensation Insurance Companies Of 2021

Do Sole Proprietors Need Workers Compensation Insurance Insureon

Post a Comment for "Do I Need Workers Compensation Insurance If I Am Self Employed"