What Does Personal Lines Insurance Mean

These would include Homeowners Renters Auto. Physical damage to the hull and protection and indemnity PI coverage.

Https Www Europarl Europa Eu Regdata Etudes Stud 2018 615635 Eprs Stu 2018 615635 En Pdf

Personal lines insurance refers to any type of insurance that protects you and covered loved ones personally including your home car health and life.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

What does personal lines insurance mean. Line 1 A class of insurance such as property marine or liability2 In reinsurance an amount of risk retained by a ceding insurer for its own account. However most personal yacht insurance policies have at least two coverages. These types of insurance policies are generally for people and their families who would not have been otherwise able to cover all their expenses resulting from a loss.

Unlike commercial lines they do not cover businesses. The term line in the insurance industry refers to a class of insurance. These insurance lines generally protect people.

Commercial lines insurance includes auto liability homeowners liability and personal property policies. Insurers and only when the insurance producer placing the business has a surplus lines license. A personal lines licensee is a person authorized to transact automobile insurance residential property insurance including earthquake and flood insurance personal watercraft insurance and umbrella or excess liability insurance providing coverage when written over one or more underlying automobile or residential property insurance policies and a personal lines broker-agent license is a license so to act.

An insurance company that sells all possible lines including personal and commercial insurance. The focus of personal lines is on protecting the financial interests of an individual or family rather than a corporate or business entity. The line varies with the insurers financial strength and with the nature of the exposure.

Surplus line insurance can be used by companies or purchased individually. Surplus lines insurance protects against a financial risk that is too high for a regular insurance company to take on. The most common types of personal line insurance are property and casualty insurance which includes automobile homeowner and renters insurance.

Generally when an excess line insurer writes a policy it must pursuant to state laws provide disclosure to the policyholder that the policyholders policy is being written by an excess line insurer. Personal lines insurance is insurance that is offered to individuals and families rather than organizations and businesses. For example on a personal auto policy the coverage liability physical damage and what it is covering the driver and vehicle is pretty much the same.

A policy that covers risks that could be distributed to separate policies and is offered to a client so that they will not buy another policy from another company. Personal lines insurance refers to the class of coverage that protects families or individuals against financial losses. The physical damage to the hull coverage provides protection against losses or damage to the boat itself including the masts spears furniture and any other fixtures on the craft.

You can also purchase an umbrella policy also considered personal lines insurance to cover anything your other policies dont include. These insurance products lower the financial risks of driving a car owning a home seeking healthcare and so on. That means everything from clothes to electronics to portable appliances are insured against covered damages or theft.

Personal lines refers to Property and Casualty insurance for an indivdiual as opposed to a business. One of the biggest reasons that personal lines insurance is so different from commercial lines is because of the similarity in insureds and the forms. What is personal liability insurance.

All lines insurance can refer to. Personal Lines Insurance protects individuals from any kind of financial loss resulting from death loss of property or injury. What is included in Personal Lines Insurance.

Personal liability occurs in the event an accident in or out of your home that results in bodily injury or property damage that you are held legally responsible for. Personal lines insurance refers to any kind of insurance that covers individuals against loss that results from death injury or loss of property. Personal property insurance or personal property coverage is a component of your homeowners insurance policy that reimburses you if your personal belongings are burglarized or damaged by a covered peril.

Personal lines insurance is purely the term used to discern personal insurance from their commercial and business equivalents. Personal Lines Insurance Personal lines insurance refer to coverage that protects families or individuals against financial losses.

Personal Liability Insurance Coverage Lemonade

What Is Insurable Interest Definitions Permanent Life Insurance Universal Life Insurance

5 Tips To Save On Your Home Insurance In Dubai Home Insurance Content Insurance Health Insurance Plans

Limit Of Liability What You Should Know Insurance Dictionary By Lemonade

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc371046e0fb00260def42.jpg)

Personal Lines Insurance Definition

What Is Personal Liability Insurance Nationwide

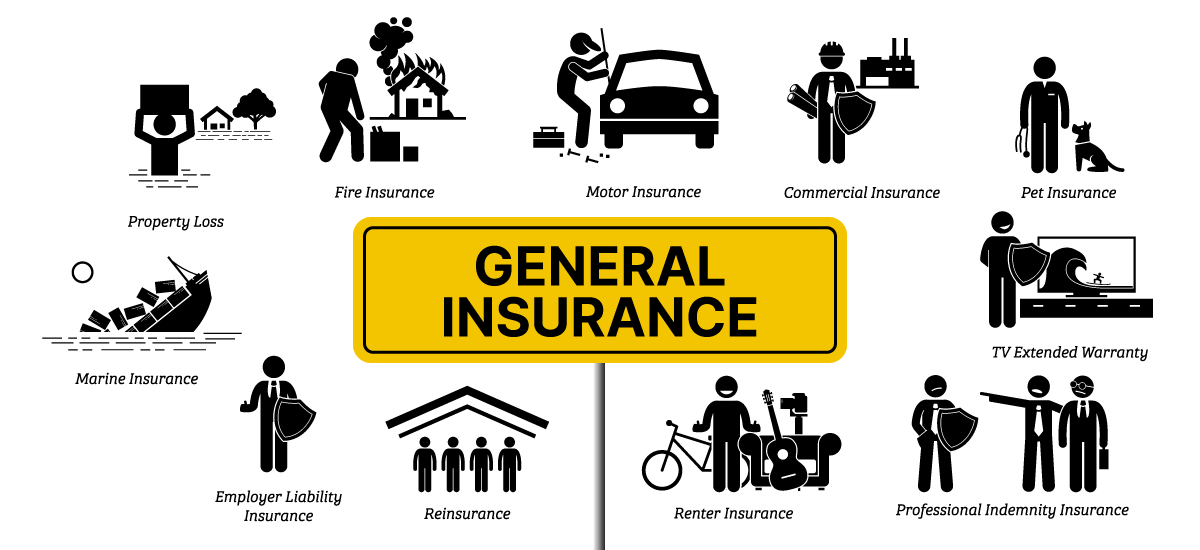

Non Life Insurance Policy Types Features And Benefits

/GettyImages-456014081-e9c3ca710ea04f85b32591c061490163.jpg)

Personal Lines Insurance Definition

Cic Certified Insurance Counselor

Why Should An Agent Choose Commercial Insurance Over Personal Insurance In 2020 Commercial Insurance Personal Insurance Property And Casualty

5 Fantastic Vacation Ideas For Colorado Health Insurance Colorado Health Insurance Https If Health Insurance Plans Health Insurance Health Insurance Broker

El Dorado Brings You Personal Liability Insurance For Your Assets Our Personal Lines Insurance Team Ha Insurance Industry Liability Insurance Insurance Agency

:max_bytes(150000):strip_icc()/EB03cropped-f264eb8ba4b545dd85243fd7e32caf35.jpg)

Personal Lines Insurance Definition

Avoiding Common Insurance Certificate Errors In Contracting Services Expert Commentary Irmi Com

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

How Much Will Auto Insurance Increase After Accident Di 2021

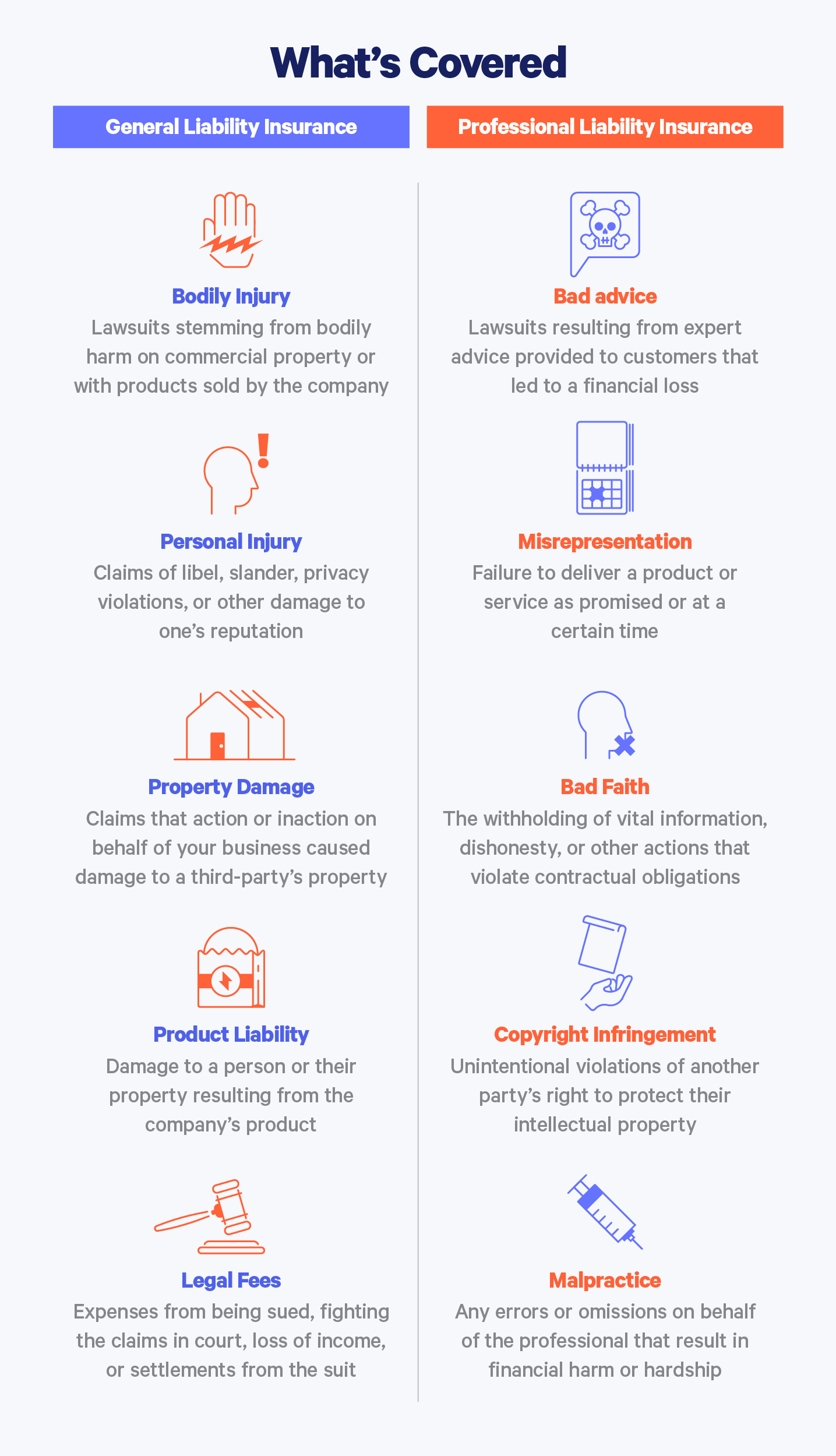

General Liability Vs Professional Liability Insurance Coverage Embroker

Twitter Universal Life Insurance Life Insurance Types Term Life

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Post a Comment for "What Does Personal Lines Insurance Mean"